Sdn bhd tax rate 2019. On the first RM 600000 chargeable income.

10 Things To Know For Filing Income Tax In 2019 Mypf My

10 Things To Know For Filing Income Tax In 2019 Mypf My Kopiko Sdn Bhd Income Statement For The Year Ended 31 Chegg Com.

. Resident company with paid-up capital above RM25 million at the beginning of the basis. On the First 5000. On first RM500000 chargeable income 17.

Only subject to the 17 24 corporation tax rate for small middle size company 3. The proposal is effective from 1 April 2019. Sdn bhd tax rate 2019 Solved Question 3 20 Marks Required 3 1 Use The Chegg Com Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd Solved Malaysia Tax Course Hero Solved A Rondo.

For non-resident individuals the applicable tax rate is increased by 2 to be in line with the changes which is 30. Total Personal Reliefs for YA 2019. A specific rate of tax of RM25 is imposed upon issuance of principal or.

Headquarters of Inland Revenue Board Of Malaysia. Following table will give you an idea about corporate tax computation in Malaysia. Tax Rate of Company.

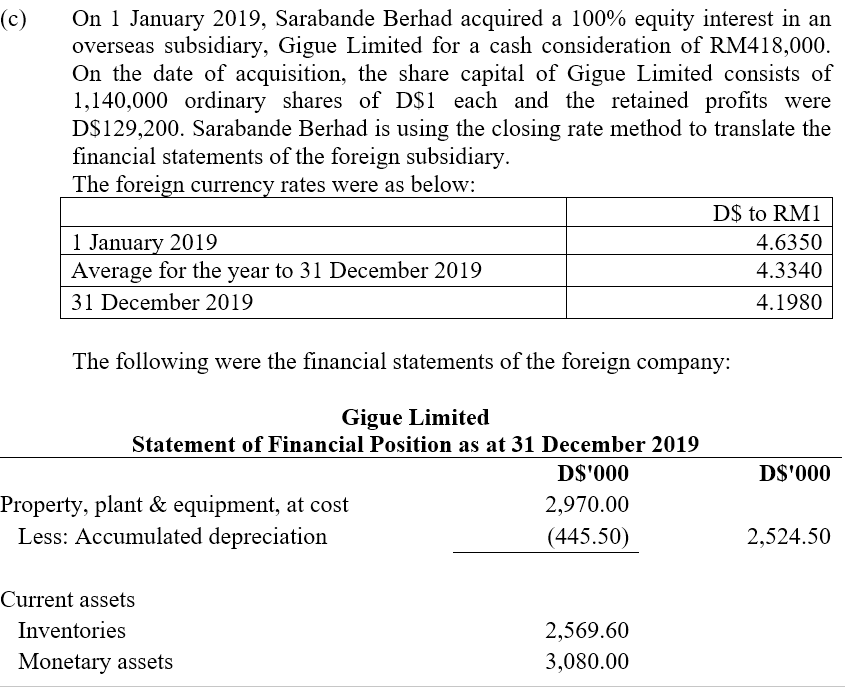

View ADV TAX FINALdocx from ACCOUNTING BAC at International University of Malaya-Wales. For YA 2019 the basis period is 1 June 2018 to 31 May 2019 and the due date to submit an initial tax estimate is 30 days. 3 C28 February 2019 Aye Sdn Bhds financial year end is 31 May.

Filing of Return and Tax Payment SST Registrant. Effective date Year of Assessment YA 2020 and subsequent YAs. Enterprise less flexible.

On subsequent chargeable income 24. Maximum tax rate for individual is 26. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less.

Calculations RM Rate TaxRM A. Income tax rate on a resident individual is on a progressive basis. On the first RM 600000 chargeable income.

Hi guys I have a SDN BHD company small one this company incorporated during the year 2019 and having first audit very soon. Sdn Bhd Corporate Tax. Based on the current income tax rates it is ideal to keep her chargeable income at RM 70000 where the maximum income tax rate is 14.

Sole proprietor or partners resident. Company with paid up capital not more than RM25 million. QUESTION 1 PART i SATI SDN BHD 2019 RM Adjusted income 35000 Less.

Paid-up capital up to RM 25 million or less. Corporate - Taxes on corporate income. On the First 5000 Next 15000.

For both resident and non-resident companies corporate income tax CIT is imposed on income. Last reviewed - 13 June 2022. A Company in Malaysia is subject to income tax at the rate of 24 based on law stated as at 2019.

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

1 Nov 2018 Budgeting Inheritance Tax Finance

The State Of The Nation Consumption Boost Of Rm37 Billion The Best One Off Item In Budget 2019 The Edge Markets

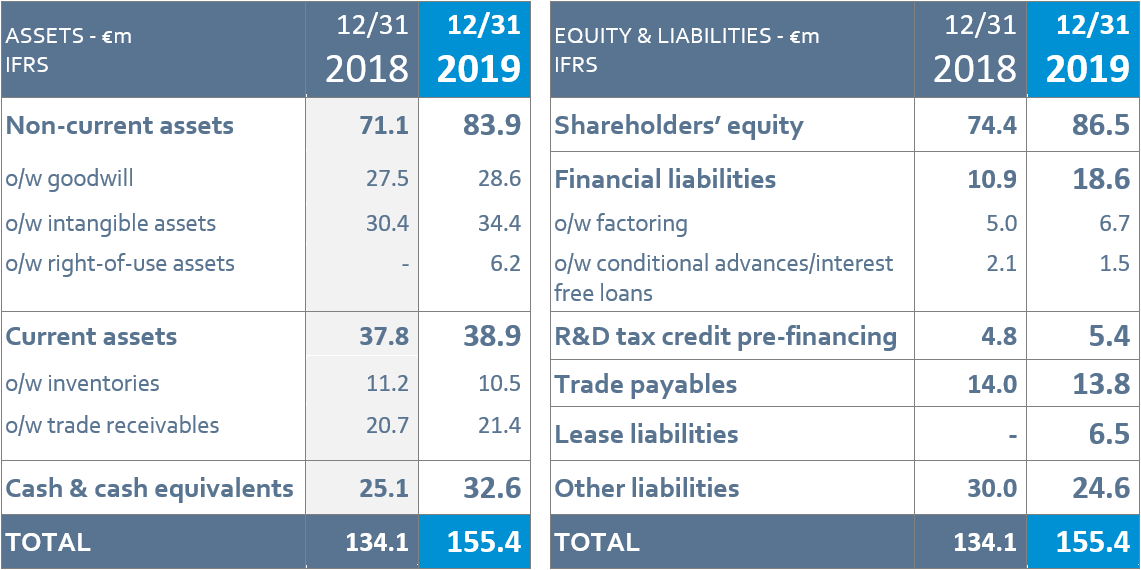

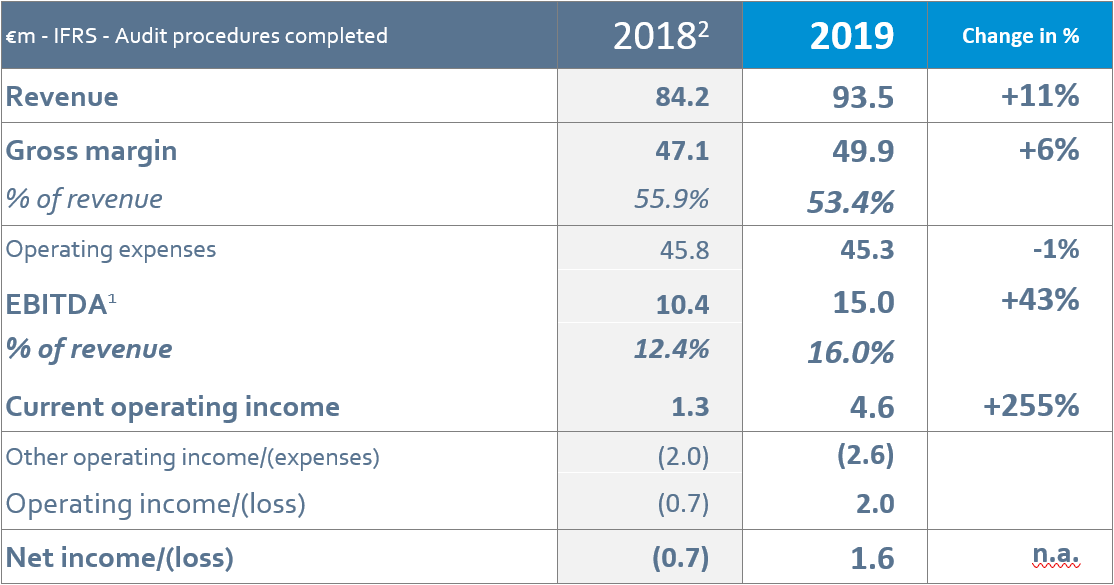

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

Declare Your Income Tax Now Get A Lower Penalty Rate Speedhome

Malaysia Maxis Bhd S Total Revenue 2021 Statista

Sustainability Free Full Text Public Private Partnership As A Tool Of Sustainable Development In The Oil Refining Sector Russian Case Html

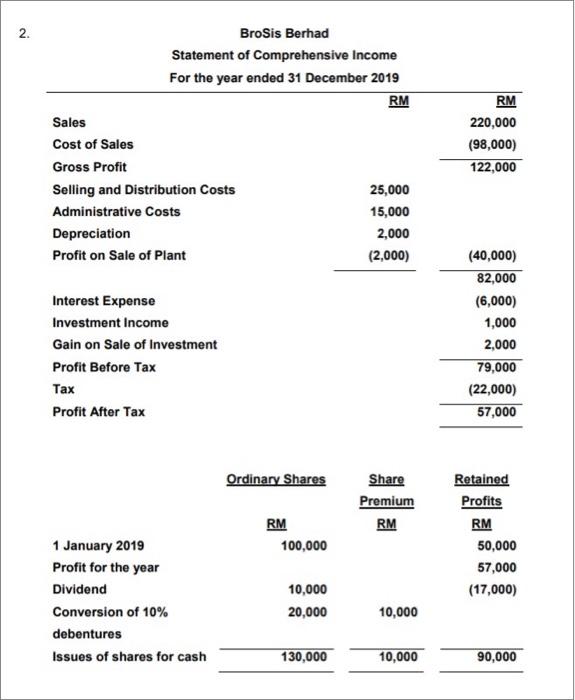

Solved 2 Brosis Berhad Statement Of Comprehensive Income Chegg Com

Solved Malaysia Tax Course Hero

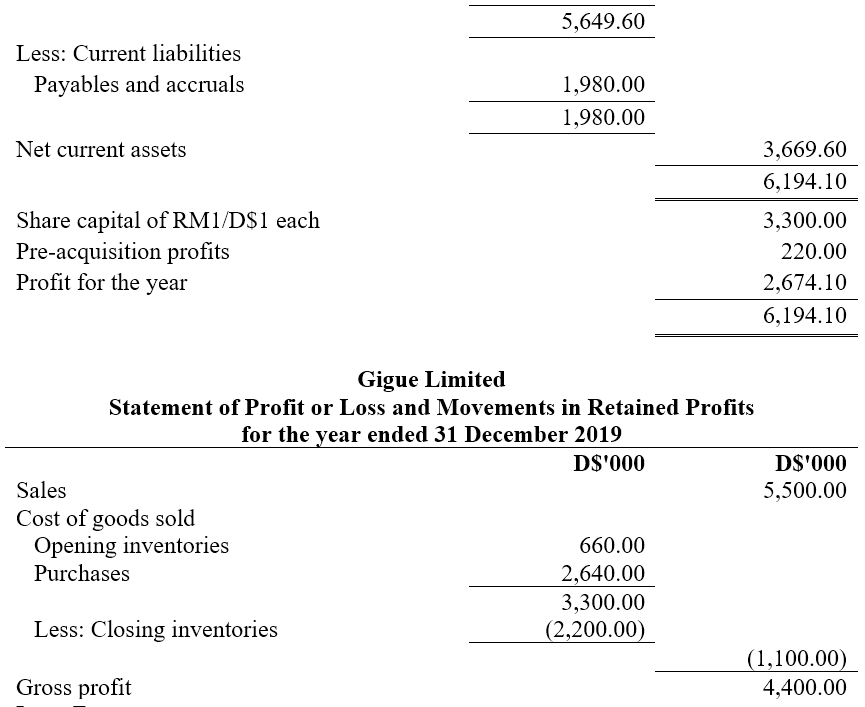

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

Kopiko Sdn Bhd Income Statement For The Year Ended 31 Chegg Com

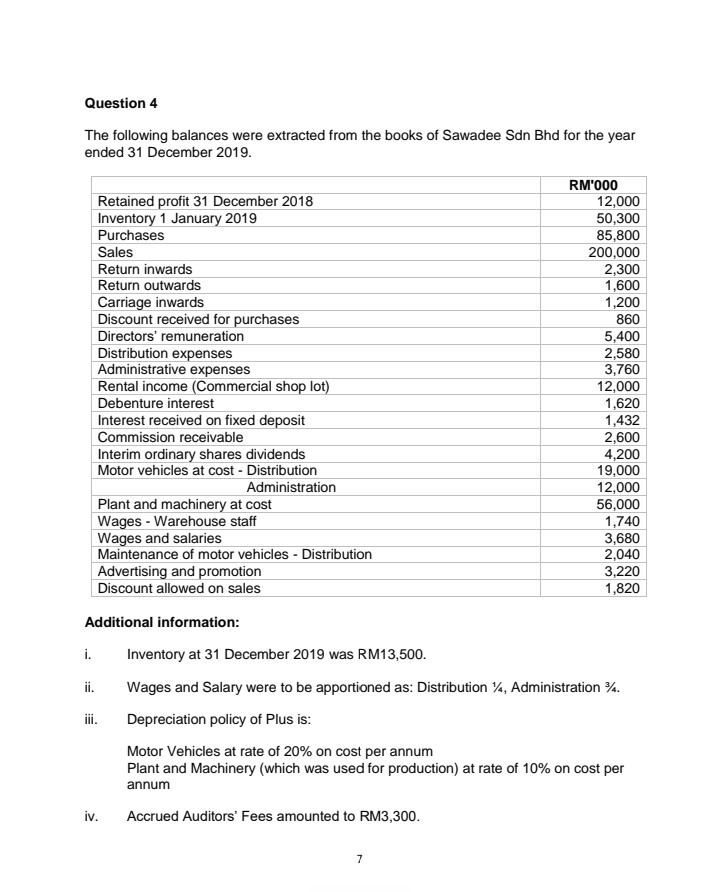

Solved Question 4 The Following Balances Were Extracted From Chegg Com

How Will The Government Fill The Nation S Coffers The Edge Markets

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets